Exceptional drilling results support high grade, large scale and continuity of FireFly’s Green Bay Copper-Gold Project

Consistently strong intersections extend known mineralisation ahead of December quarter Mineral Resource Estimate update; First results from economic studies due early next year

KEY POINTS

- FireFly made rapid progress during the quarter across the four key planks of its growth strategy; These comprise Mineral Resource growth, upgrading Inferred Resources to the Measured and Indicated (M&I) categories, new discoveries, and economic studies for an upscaled production restart at the Green Bay Project in Canada

- Growing global investor recognition of the strong outlook at Green Bay was reflected in FireFly’s addition to the S&P/ASX 300 Index

- Subsequent to the end of the quarter, FireFly announced assays from step-out drilling which extended the known mineralisation by another 650m (see ASX announcement dated 16 October 2025)

-

The results included:

-

49.0m @ 6.1% copper equivalent (CuEq)1 (4.9% Cu & 1.3g/t Au) in hole MUG25-202 (~39.2m true thickness), including 14.3m @ 13.7% CuEq (10.6% Cu & 3.2% Au) (see ASX announcement dated 16 October 2025)

-

49.0m @ 6.1% copper equivalent (CuEq)1 (4.9% Cu & 1.3g/t Au) in hole MUG25-202 (~39.2m true thickness), including 14.3m @ 13.7% CuEq (10.6% Cu & 3.2% Au) (see ASX announcement dated 16 October 2025)

-

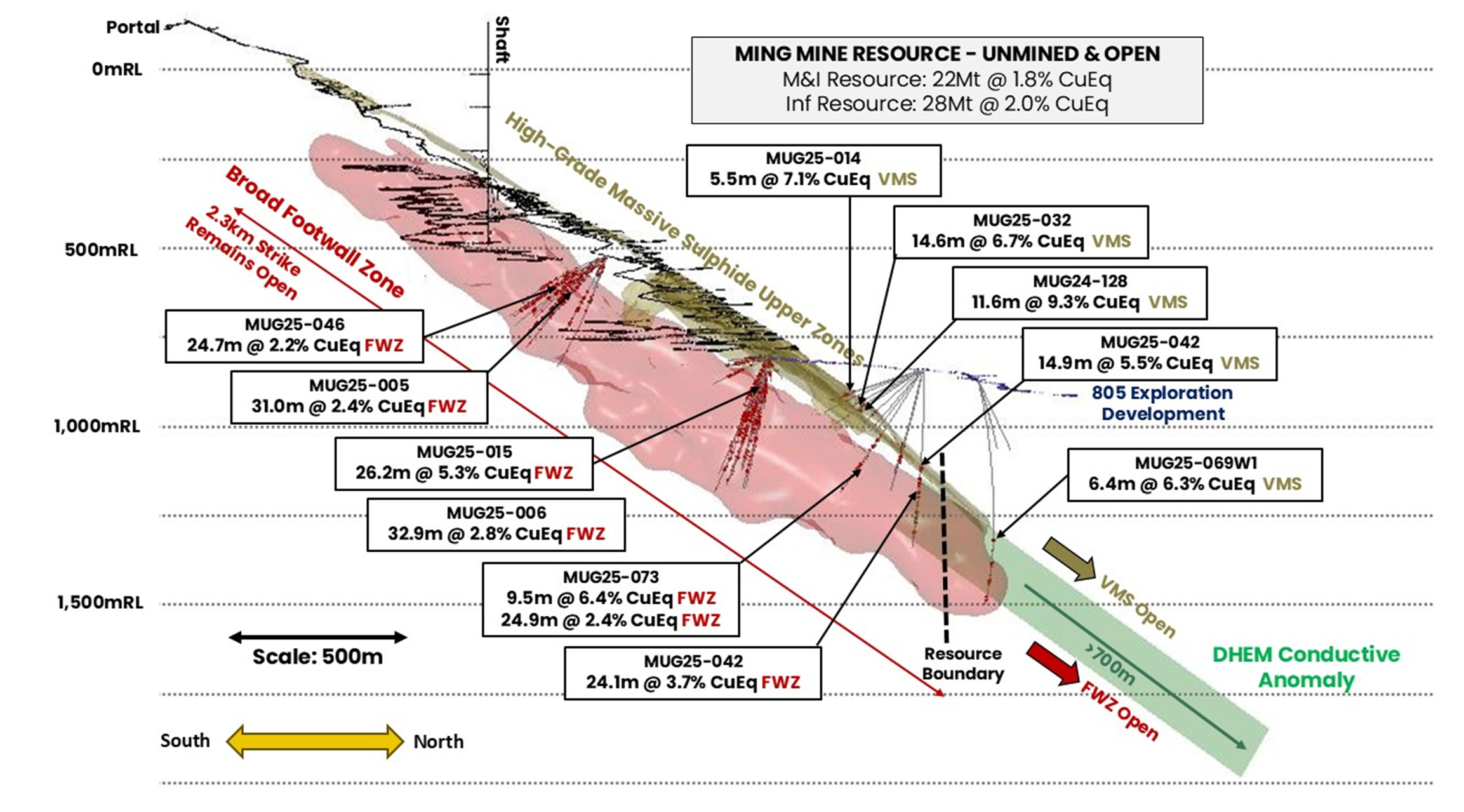

Infill drilling of the Volcanogenic Massive Sulphide (VMS) lenses continued to generate outstanding assays including (see ASX announcement dated 17 July 2025):

- 11.6m @ 9.3% CuEq1 (6.0% Cu & 3.9g/t Au) in hole MUG24-128 (~ true thickness)

- 5.5m @ 7.1% CuEq (5.4% Cu & 2.0g/t Au) in hole MUG25-014 (~ true thickness)

-

14.6m @ 6.7% CuEq (5.4% Cu & 1.5g/t Au) in hole MUG25-032 (~ true thickness)

-

Drilling of the broad Footwall Stringer Zone continued to demonstrate thick and consistent copper mineralisation, pointing to the potential for large-scale bulk mining. Intersections include (see ASX announcement dated 17 July 2025)

- 9.5m @ 6.4% CuEq (6.1% Cu & 0.4g/t Au) followed by a further zone of 24.9m @ 2.4% CuEq (2.2% Cu & 0.1g/t Au) in hole MUG25-073 (~ true thickness)

- 26.2m @ 5.3% CuEq (4.9% Cu & 0.4g/t Au) in hole MUG25-015 (~ true thickness)

-

24.1m @ 3.7% CuEq (3.5% Cu & 0.3g/t Au) in hole MUG25-042 (~ true thickness)

- The first modern geophysical programs were completed over the project area, resulting in numerous significant drill-ready targets being defined (see ASX announcement dated 24 July 2025)

- FireFly continued to lay the foundations at Green Bay with environmental approvals for an upscaled restart operation now secured,2 mining studies and construction permitting underway and metallurgical tests returning outstanding results (see ASX announcement dated 5 August 2025)

- Metallurgical tests on 1.5 tonnes of material from the Ming Mine showed that the mineralisation is metallurgically amenable to conventional low-cost processing, with copper recovery exceeding 98% and gold recovery exceeding 85% (see ASX announcement dated 5 August 2025)

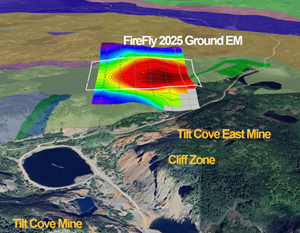

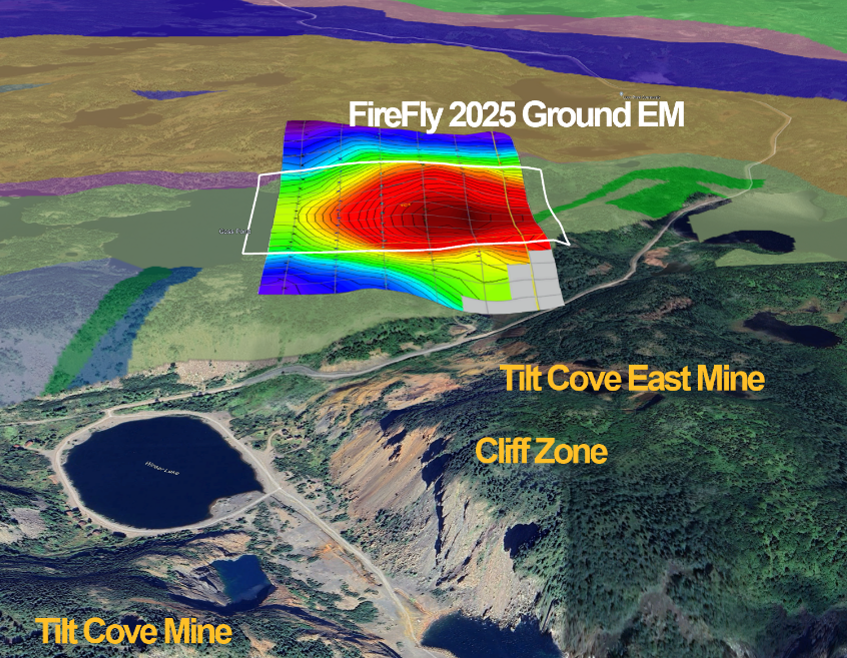

- Exploration activities commenced at the prospective Tilt Cove Project that was acquired by the Company in late 2024; Historical mining at the Tilt Cove Mine, only ~30km east of the Ming Mine, produced ~170,000t of copper and 50,000oz of gold from a large-scale Volcanogenic Massive Sulphide (VMS) system (see ASX announcement dated 24 July 2025)

- Ground-based EM completed by FireFly at Tilt Cove confirmed an extensive untested conductive anomaly first identified by Newmont Exploration in the 1980s; Drill testing of the anomaly is planned for Q4 2025 (see ASX announcement dated 24 July 2025)

- FireFly successfully completed the second tranche of an equity raising and share purchase plan (SPP) (see ASX announcement dated 11 July 2025 and 3 September 2025)

- The Company emerged with ~A$129.7m3 in cash and liquid investments, ensuring it is well funded to execute the aggressive eight-rig drilling strategy and mining studies

|

FireFly Managing Director Steve Parsons said: “The momentum at Green Bay continues to build, with exceptional drilling results and strong progress on upscaled production re-start studies. “We are now seeing the benefits of our eight-rig drilling strategy, which continues to both extend and infill the known mineralisation. We are looking forward to feeding these results into the Mineral Resource Estimate update planned for later this year. “In parallel with the aggressive drilling campaign, we have identified numerous compelling targets which we will test early next year. These have the potential to make a significant impact on the project. “And our economic studies are progressing well, with metallurgical tests and engineering work among the activities underway on this front.” |

PERTH, Australia, Oct. 29, 2025 (GLOBE NEWSWIRE) -- FireFly Metals Ltd (ASX/TSX: FFM) (FireFly or the Company) is pleased to report on a highly productive quarter which saw the Company generate more outstanding drilling results ahead of its next Mineral Resource Estimate update and progress its studies on an upscaled production restart at Green Bay.

HIGH-GRADE INFILL DRILLING

During the quarter, FireFly announced outstanding assays from infill drilling which continue to show why Green Bay is a world-class copper-gold project with very high grades, continuous mineralisation, scale potential and existing infrastructure in a tier-one location.

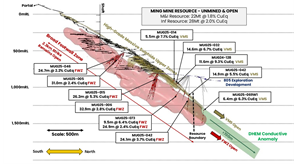

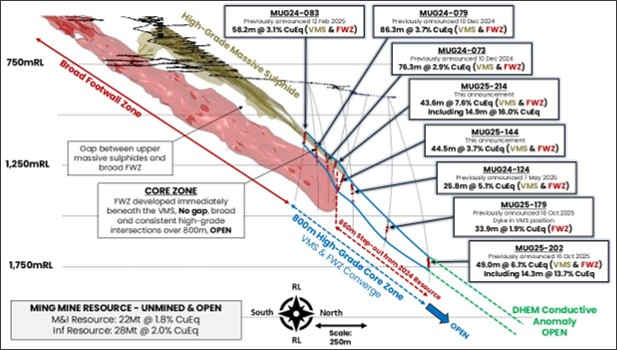

Figure 1: Long section through the Green Bay Ming underground mine showing the location of select drill results from ASX announcement dated 17 July 2025. Results from both the high-grade copper-gold VMS zone and broad copper Footwall Zone are shown. The green shape is a modelled DHEM anomaly (from hole MUG25-040 - see ASX announcement dated 7 May 2025 for further details). Drill assays >0.5% copper are shown in red.

The current Mineral Resource Estimate at the Green-Bay Copper-Gold Project stands at 24.4Mt @ 1.9% for 460Kt CuEq of M&I Resources and a further 34.5Mt @ 2.0% for 690Kt CuEq of Inferred Resources (see ASX announcement dated 29 October 2024).

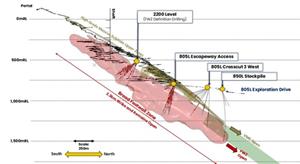

An extensive six-rig underground drill campaign is underway with the dual objectives of growing the current Mineral Resource (four rigs) and upgrading more of the Inferred Resources to the higher-confidence Measured and Indicated (M&I) categories (2 rigs).

The upcoming Mineral Resource Estimate (MRE) update, due later this year, will underpin upscaled mining and economic studies currently underway and scheduled for completion in early CY2026.

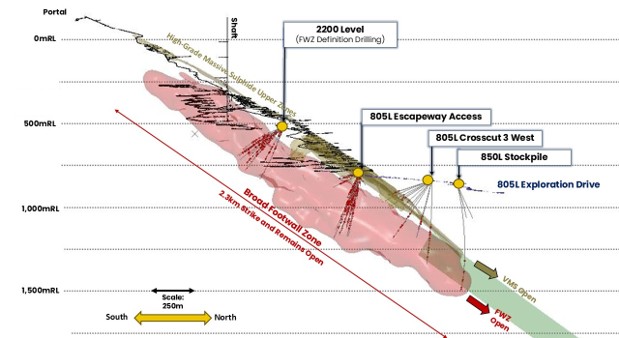

Figure 2: Long section through the Ming Mine highlighting the current ~800m strike of the extremely high-grade core zone and remains open. The FWZ stringer style mineralisation is developed directly beneath the upper high-grade VMS. Clipping +/- 30m

About the Drill Results

FireFly acquired the Green Bay Copper-Gold Project in October 2023 and began an extensive underground drilling campaign at Ming Mine. Since this time, the Company has completed approximately 123,064m of diamond core drilling to 30 September 2025. The diamond drilling is part of the extensive underground development program for the planned upscaling of the past-producing Ming Mine.

There are two distinct styles of mineralisation present at the Green Bay Ming Mine, consisting of a series of upper copper-gold rich Volcanogenic Massive Sulphide (VMS) lenses underlain by a broad copper stringer zone, known as the Footwall Zone (FWZ).

The Footwall Zone is extensive, with the stringer mineralisation observed over thicknesses of ~150m and widths exceeding 200m. The known strike of the mineralisation defined to date is 2.3km and it remains open down-plunge (see ASX announcement dated 16 October 2025).

Drilling continues to demonstrate continuity of the high-grade copper-gold rich VMS mineralisation, with key intersections including 11.6m @ 9.3% CuEq, 14.6m @ 6.7% CuEq, 14.9m @ 5.5% CuEq and 5.5m @ 7.1% CuEq (~true widths) (see ASX announcement dated 17 July 2025).

Infill drilling of the broader copper-rich footwall stringer zone repeatedly intersected thick and continuous mineralisation exceeding 2% copper. Highlights include 26.2m @ 5.3% CuEq, 24.1m @ 3.7% CuEq and 9.5m @ 6.4% CuEq (~ true widths) - supporting the possibility of bulk‐scale mining from the footwall domain (see ASX announcement dated 17 July 2025).

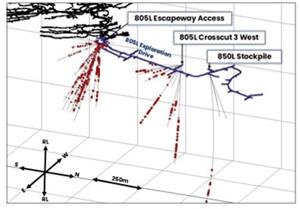

The development of phase two of the 805L exploration drive has now been completed. Two drill rigs have been mobilised to the northern extent of the platform and are testing mineralisation up to 650m beyond the current MRE. Subsequent to the quarter, on 16 October 2025, it was announced that results of such drilling extended the known mineralisation by 430m beyond previous drilling and more than 650m beyond the current MRE.

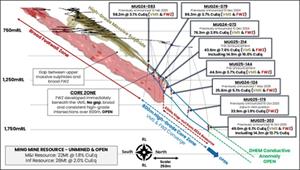

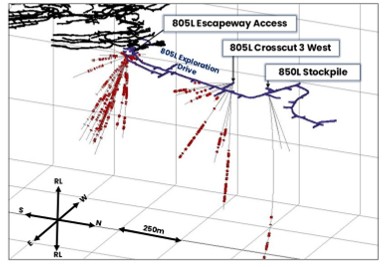

Figure 3: Long section through the Ming Mine showing the location of drill platforms and drilling reported in the ASX announcement dated 17 July 2025. Assay results greater than 0.5% Cu are shown in red.

Resource Conversion Drilling from the 805L Exploration Drive

Drilling from the 805L drill drive focused primarily on upgrading the data density in the high-grade copper-gold dominated VMS lenses defined by previously reported exploration drilling. The results demonstrate strong continuity and consistent high grades in the Ming North and South VMS lenses in addition to the FWZ (where targeted).

Drilling from the 805L was predominantly completed from the 805L Crosscut 3 West, 805 Escapeway Access and the 850L stockpile (Figure 3).

Figure 4: Isometric view of drill positions in the 805L Exploration drill drive. Drill results from the ASX announcement dated 17 July 2025 are shown with copper assays >0.5% shown in red.

Significant intersections4 announced on 17 July 2025 from resource definition drilling include, but are not limited to:

805L Crosscut 3 West

Hole MUG24-128 comprised of a thick copper and gold rich massive sulphide zone with local sericite altered stringers immediately beneath, delivering an intersection of:

- 11.6m @ 6.0% Cu, 3.9g/t Au, 11.4g/t Ag, 0.1% Zn (9.3% CuEq) from 187.4m (VMS-style)

Hole MUG25-032 contained an upper copper-gold massive sulphide zone grading into upper footwall style stringers:

- 14.6m @ 5.4% Cu, 1.5g/t Au, 11.6g/t Ag, 0.3% Zn (6.7% CuEq) from 214.7m (VMS-style)

Hole MUG25-014 intersected a massive sulphide zone with strong copper-gold mineralisation:

- 5.5m @ 5.4% Cu, 2g/t Au, 8.1g/t Ag, 0.4% Zn (7.1% CuEq) from 208m (VMS-style)

805L Escapeway Access

Hole MUG25-015 intersected a thick zone of very high-grade stringer-style mineralisation, with chalcopyrite routinely exceeding 10% of the zone:

- 26.2m @ 4.9% Cu, 0.4g/t Au, 7g/t Ag, 0.03% Zn (5.3% CuEq) from 167m (FW Stringer-style)

Hole MUG25-006 included numerous zones of copper stringer-style mineralisation, including:

- 32.9m @ 2.7% Cu, 0.1g/t Au, 2.9g/t Ag, 0.04% Zn (2.8% CuEq) from 154.2m (FW Stringer-style)

- 21.8m @ 2.0% Cu, 0.1g/t Au, 2.4g/t Ag, 0.01% Zn (2.1% CuEq) from 213m (FW Stringer-style)

Hole MUG25-009 intersected multiple thick zones of footwall stringer style mineralisation, including:

- 8.0m @ 2.1% Cu, 0.2g/t Au, 2.6g/t Ag, 0.01% Zn (2.3% CuEq) from 120m (FW Stringer-style)

- 4.3m @ 1.5% Cu, 0.1g/t Au, 2.4g/t Ag, 0.01% Zn (1.7% CuEq) from 155m (FW Stringer-style)

Hole MUG25-001 contained multiple zones of copper-dominated footwall stringer style mineralisation, including:

- 14.0m @ 1.8% Cu, 0.3g/t Au, 2.7g/t Ag, 0.04% Zn (2.1% CuEq) from 86m (FW Stringer-style)

- 15.6m @ 1.4% Cu, 0.1g/t Au, 2g/t Ag, 0.02% Zn (1.5% CuEq) from 150.9m (FW Stringer-style)

805L Stockpile

Hole MUG25-069W1 from the 850L Stockpile, the northernmost drilling completed to date, confirmed the presence of strong VMS-style mineralisation underlain by a broad footwall stringer zone. This stringer zone is at the projected margins of the lower footwall zone. Key intersections included:

- 6.4m @ 3.0% Cu, 3.6g/t Au, 25.6g/t Ag, 0.9% Zn (6.3% CuEq) from 458.7m (VMS-style)

- 20m @ 1.3% Cu, 0.1g/t Au, 1.3g/t Ag, 0.06% Zn (1.4% CuEq) from 572m (FW Stringer-style)

Resource Conversion Drilling from the 2200L Exploration Drive

Resource conversion drilling from the historical 2200 level of the Ming Mine is targeting an area of low drill density higher up in the mine, down-plunge of the historical shaft. (~500m RL).

Significant intersections5 announced on 17 July 2025 include, but are not limited to:

Hole MUG25-046 contained numerous mineralised zones throughout the hole, headlined by the broad intersection of:

-

24.7m @ 2.1% Cu, 0.2g/t Au, 2.3g/t Ag, 0.02% Zn (2.2% CuEq) from 201m (FW Stringer-style), including:

-

9.7m @ 2.8% Cu, 0.2g/t Au, 3.2g/t Ag, 0.02% Zn (3.0% CuEq) from 216m

-

9.7m @ 2.8% Cu, 0.2g/t Au, 3.2g/t Ag, 0.02% Zn (3.0% CuEq) from 216m

Hole MUG25-005 intersected multiple zones of stringer-style copper dominated mineralisation, including:

- 5.4m @ 1.8% Cu, 0.1g/t Au, 2.0g/t Ag, 0.04% Zn (2.0% CuEq) from 130m (FW Stringer-style)

- 31.0m @ 2.2% Cu, 0.3g/t Au, 2.3g/t Ag, 0.02% Zn (2.4% CuEq) from 156m (FW Stringer-style)

Hole MUG25-034 drilled multiple zones of stringer-style chalcopyrite rich veins, with key intersections including:

- 8m @ 2.0% Cu, 0.2g/t Au, 2.5g/t Ag, 0.01% Zn (2.2% CuEq) from 138.7m (FW Stringer-style)

- 6.4m @ 1.8% Cu, 0.1g/t Au, 1.7g/t Ag, 0.01% Zn (1.9% CuEq) from 154.7m (FW Stringer-style)

STEP-OUT DRILLING FOR MINERAL RESOURCE GROWTH

During the quarter, FireFly conducted step-out drilling from the end of the Ming Mine exploration drive. Subsequent to the quarter, on 16 October 2025, it was announced that the results of such drilling extended the known mineralisation by 430m beyond previous drilling and more than 650m beyond the current MRE.

METALLURGICAL RESULTS

On 5 August 2025, FireFly announced results from a comprehensive metallurgical test program completed on ~1,500 kg of bulk samples of mineralisation from the Ming Mine at Green Bay, undertaken at the SGS Canada Inc. (SGS) metallurgical facility in Lakefield, Ontario.

The bulk samples for metallurgical testing incorporated representative samples of both the high-grade VMS lenses and the broader FWZ, and included numerous blend ratios to inform the economic studies.

The metallurgical test work is a key component of the economic studies currently underway, which will be incorporated into the Scoping Study6 due for completion in the March quarter of 2026.

Using an optimised flowsheet, metal recoveries to final copper concentrate from all samples averaged +98% for Copper, +75% for Gold and +78% for Silver. Subsequent gravity and conventional leach testing of the pyrite flotation tails improved precious metals recoveries, with gold recovery rising to +85% and silver to +84%.

These results are a significant improvement in comparison to recoveries attained by the previous operator through the small-scale 500ktpa Nugget Pond processing plant.

The improved gold recovery has the potential to enhance the economics of the upscaled restart, with the current MRE containing a total of 550koz of gold7 across all Mineral Resource categories, making it a significant contributor to potential future cash flow.

The ore proved metallurgically simple and amenable to conventional, low-cost processing, backed by favourable grindability (Bond Work Index of 10.4-11.4 kWh/t) and low abrasive index (0.1-0.18 g), suggesting lower than average power, maintenance and consumable costs.

These positive results will feed directly into refining processing design, cost models, and revenue assumptions in the upcoming economic and scoping studies.

ENVIRONMENTAL APPROVAL

FireFly is rapidly laying the foundations for a staged upscaled production restart at Green Bay.

As announced on 5 August 2025, FireFly has obtained a conditional environmental release (Environmental Release) from the Province of Newfoundland and Labrador that permits an initial upscaled restart of operations at Green Bay, with a processing plant throughput capacity of 1.8 Mtpa.8

As a result of this decision, no further detailed environmental and socio-economic assessments are required for that scale of restart, enabling FireFly to proceed toward construction permit applications and early works.

Applications for construction permits are underway, and early seasonal site preparation works are planned to begin in late 2025.

Ongoing environmental monitoring and closure planning are in progress, supported by external consultants to ensure compliance, including with the conditions of the Environmental Release.

The plant capacity is a technical specification forming part of the environmental submission and not a forecast of the estimated production of the mining operation. The mining operation’s forecast production will not be estimated until such time as the Company has prepared and announced its Scoping Study. Should a larger scale case be adopted than contemplated by the Environmental Release, further assessment may be required by government agencies.

ENGINEERING STUDY UPDATES

FireFly has engaged leading consultants to progress optimal mining and processing designs.

Conceptual mining studies by Entech recommend Transverse Long Hole Open Stoping (TLHOS) for the broader footwall zones and conventional Long Hole Open Stoping (LHOS) for the high-grade VMS zones, both utilising full backfill strategies to optimise extraction.

The Company is designing a paste backfill system that can encapsulate over 50% of tailings underground, offering both operational and environmental benefits.

Process engineering progress is also being advanced. Ausenco is refining the process flowsheet, incorporating the recent metallurgical testwork to guide design choices.

Preliminary design and trade-off studies for the tailings storage facility (TSF) have been completed by Knight Piesold, with final designs to be delivered in the coming months. Sterilisation and geotechnical drilling in the proposed TSF and processing plant areas have confirmed favourable rock conditions and did not intersect mineralisation.

Newfoundland and Labrador Hydro is conducting the power supply studies which are due for completion before the end of the year. Existing high voltage hydro transmission lines traverse the property and are expected to play an important role in the future development of the upscaled production at the Ming Mine.

In March 2025, Natural Resources Canada (NRCan) announced conditional approval of contribution funding of the Green Bay Power Assessment Project through the Critical Minerals Infrastructure Fund. Subsequent to the quarter, on 2 October 2025, NRCan and FireFly signed a non-repayable contribution agreement for up to C$613,775 in funding to support the Project. This project will advance electrification studies to support the development of infrastructure required to expand critical minerals production in the Province of Newfoundland and Labrador.

The overall study timeline suggests completion of a Scoping Study9 in the March quarter of 2026. The Scoping Study will integrate the mining, processing, infrastructure and permitting elements into one cohesive economic assessment.

REGIONAL EXPLORATION AND GREENFIELDS COPPER-GOLD TARGETS

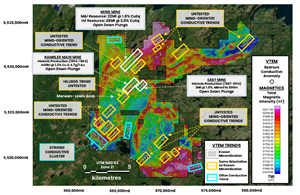

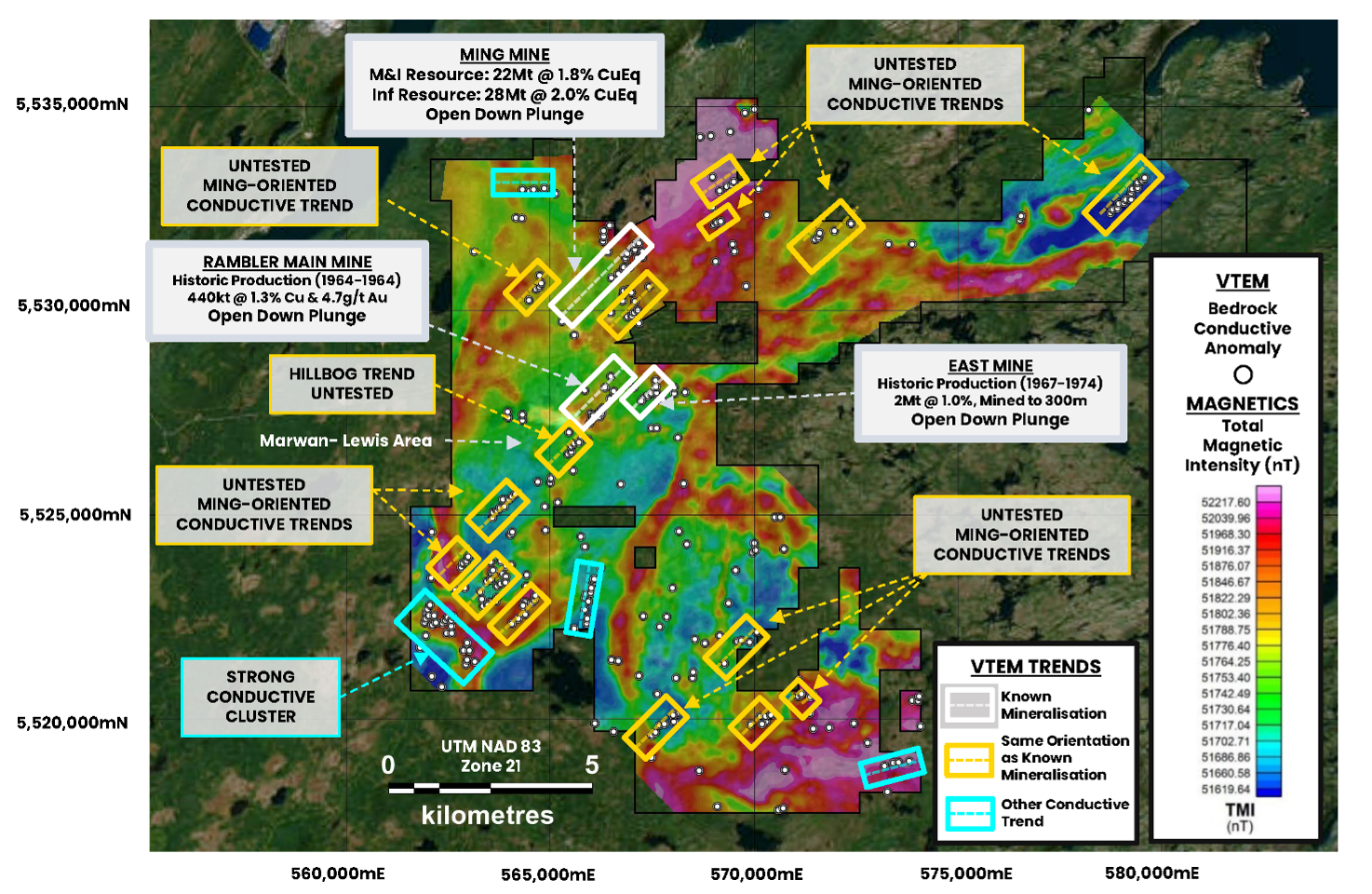

On 24 July 2025, the Company announced the results of a modern geophysical campaign over the central Green Bay Copper-Gold Project claims, which has identified 325 conductive anomalies potentially caused by copper-gold bearing sulphide mineralisation considered to be look-alikes to the known deposits (e.g. Ming, Rambler Main, East Mine). The surveys, comprising airborne electrical (VTEM) and magnetic data plus localised ground electromagnetic (EM) follow-up, represent the first modern regional geophysics over the area and strengthen the case for significant discovery upside.

Geophysics is a key exploration tool at Green Bay, with the mineralisation at the Ming deposit and other known deposits exhibiting strong responses to electromagnetic surveys due to the conductive nature of the chalcopyrite-rich sulphide mineralisation.

Many of the 325 anomalies occur as coherent trends that exhibit strong resemblance to known mineralisation in the district. Similarities include geological setting, orientation of the trends (North-East, similar to Ming), and magnitude of the conductive responses.

Due to the significant number of high priority new geophysical targets, FireFly has mobilised a second surface diamond drill rig and plans to accelerate surface exploration, particularly in prospective zones such as the Hillbog and Southwest areas adjacent to the Ming, Rambler, and East Mines. The Company plans to systematically drill test the high-priority anomalies beyond the known deposits to confirm the cause of the anomalous response, which could include copper and gold bearing sulphides.

Based on the strength of the targets generated, the Company intends to fast-track the surface discovery program with part of the proceeds of the recent capital raising. A total of ~C$10 million raised via the issue of Canadian flow-through shares as part of the June 2025 equity raising (see ASX announcement dated 5 and 10 June 2025) has been allocated to discovery, targeting and testing of greenfields areas at Green Bay through to December 2026.

Recently, surface drilling has been focused on testing mineralisation proximal to historical deposits such as the Rambler Main and East Mines. Results previously announced from drilling at Main Mine included 10m @ 6.4% CuEq and 12.9m @ 4.3% CuEq (see ASX announcement dated 15 May 2025).

Figure 5: Multiple significant new targets from the recent airborne VTEM and magnetic geophysical surveys. The white dots represent bedrock conductive anomalies. There are numerous untested conductive trends in a similar orientation (yellow boxes) to the known mineralisation at the Ming, Rambler Main and East Mines (white boxes). So far, a total of 325 conductive responses have been identified which are significant and potentially caused by copper-gold bearing sulphide mineralisation.

Initial Targets

TILT COVE PROJECT

FireFly has commenced exploration at the recently acquired Tilt Cove Project, located approximately 30 km east of the Ming Mine. Tilt Cove is a large-scale copper-gold VMS system that historically produced around 170,000 t of copper and 50,000 oz of gold between 1864 and 1967, with limited modern exploration completed since.

Ground EM surveys have confirmed a strong, large-scale conductive anomaly (Figure 6) at the project, which is scheduled for drill testing later in 2025 (see ASX announcement dated 24 July 2025).

In addition, FireFly is completing a lease-wide airborne VTEM and magnetic survey over the project area, the first of its kind at Tilt Cove, with results to be reported as they become available (see ASX announcement dated 27 October 2025).

RAMBLER MAIN MINE AND EAST MINE AREA: HILLBOG TARGET

In addition to identifying the surface expression of both historical Rambler Main and East Mines, the airborne VTEM survey identified a large previously unknown look-alike anomaly 300m to the south of Rambler Main Mine, known as Hillbog (see ASX announcement dated 24 July 2025).

Drilling of this target has commenced.

SOUTHWEST TARGET AREA

In the Southwest portion of the Green Bay Project, approximately 8 km SW of Ming Mine, a series of large untested EM anomalies have been defined in prospective volcanic rocks (Figure 6). The area is covered by glacial sediments and boulders with very little outcropping exposures. The EM response is similar to known mineralisation within past producing copper mines on FireFly’s land package.

Figure 6: Tilt Cove Copper-Gold Project area showing the large-scale conductor (red) identified by FireFly’s ground-based EM survey. This conductor is significant and potentially caused by copper-gold bearing sulphide mineralisation. These results confirm an anomaly earlier identified in a 1983 EM survey completed by Newmont Exploration. The anomaly has yet to be drill tested and will be the subject of maiden drilling later in 2025.

FORWARD WORK PLANS

Near-term drilling activities at the Green Bay Copper-Gold Project will continue to focus on three key areas: Mineral Resource Growth, Upgrading the Mineral Resource (with infill drilling results) and New Discoveries from both underground and surface. At 30 September 2025, the Company had completed 251 drill holes for ~123,064 metres of underground diamond drilling. A total of six underground rigs will continue to advance the underground Mineral Resource growth and development activities. Additionally, a second surface drill rig has been mobilised to fast-track surface regional discovery.

Green Bay (Ming Mine) Mineral Resource Growth and Development

The low-cost Mineral Resource growth strategy is underpinned by the 805L exploration drill drive at the Ming Mine. The Company has invested in 2,335 metres of underground exploration and ancillary development since acquisition of the project in October 2023 to provide drill platforms to accelerate growth and discovery from underground. The second phase of 805L Exploration drive has been completed, providing locations for both infill drilling and further down-plunge Mineral Resource extension. Underground drilling from the drill drive is currently underway to test the Ming mineralisation up to 650m beyond the current Mineral Resource boundary. Subsequent to the quarter, on 16 October 2025, it was announced that initial results of such drilling extended the known mineralisation by 430m beyond previous drilling and more than 650m beyond the current MRE. The relevant results included:

-

49.0m @ 6.1% CuEq (4.9% Cu & 1.3g/t Au) in hole MUG25-202 (~39.2m true thickness), including 14.3m @ 13.7% CuEq (10.6% Cu & 3.2% Au) (see ASX announcement dated 16 October 2025).

Development of additional platforms for further ongoing exploration and infill drilling will continue at Ming throughout 2025.

Upgrading the MRE remains a key priority for the Company’s plans to resume upscaled mining at Green Bay. Infill drilling is expected to upgrade the Inferred Resource (34.5Mt @ 2.0% CuEq) at Ming to the higher quality M&I Resource categories which currently stand at 24.4Mt @ 1.9% CuEq10.

Based on results to date, it is likely that the amount of mineralisation classified as M&I will increase in the MRE update currently planned by year-end 2025.11 This will be important for future economic studies.

Economic evaluation of the proposed upscaled resumption of production at Green Bay is in full-swing. Key consultants have been appointed to complete the economic studies, including Entech, Ausenco, Stantec and Knight Piesold. SGS have completed comprehensive metallurgical test work on samples of both VMS and footwall stringer-style mineralisation. The results have demonstrated considerable improvement (see ASX announcement dated 5 August 2025). Such results are expected to be a catalyst for ongoing discussions with potential offtake groups interested in securing the high-quality copper-gold concentrate expected to be produced from the Ming Mine. Various scenarios for an upscaled restart to operations are being evaluated. With the huge success of the drilling programs to date, the Company wishes to avoid unnecessarily limiting the size of any future potential upscaled mining operation until it has completed the next phase of growth drilling.

The first economic studies are currently planned for completion in Q1 2026.10

Having received from the Environmental Release from the Newfoundland and Labrador Department of Environment and Climate Change, FireFly will has now commenced applying for early works and construction permits.

Green Bay (Ming Mine) Regional Discovery

Based on the quality of targets identified, the Company is accelerating the regional discovery program at Green Bay over the next 6-12 months.

Surface drilling during 2025 has focused on extensions of mineralisation at Rambler Main Mine. Further assay results from this program are expected in the coming weeks. The second surface rig is testing targets beyond the known deposits. Key priority areas to be tested include the Hillbog prospect and Southwest target area.

Geophysics is a key exploration tool at Green Bay, with the mineralisation at Ming and other known deposits exhibiting strong responses to electromagnetic surveys due to the conductive nature of the chalcopyrite-rich sulphide mineralisation.

Targets identified by recent VTEM surveys are scheduled to be systematically drill tested in upcoming exploration drilling campaigns through to December 2026.

Exploration will also ramp up at the Company’s Tilt Cove Project. Follow-up drill testing of the conductive anomaly, that was confirmed by ground-based EM, is scheduled before the end of 2025.

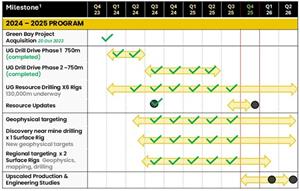

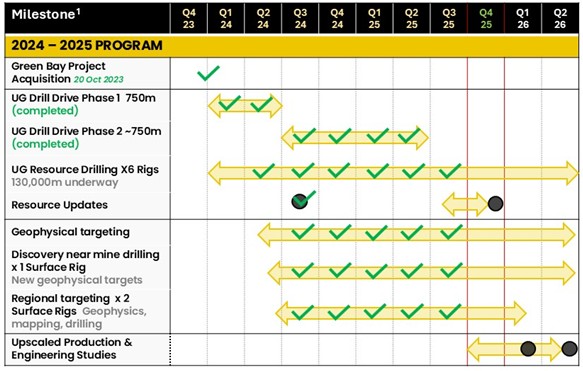

Figure 7: Key 2024-2025 milestones for the Green Bay Copper-Gold Project.

1. Timelines are indicative and may be subject to change.

PICKLE CROW GOLD PROJECT

No field activities were undertaken by the Company at the Pickle Crow Gold Project during the quarter due to the team’s focus on the development and exploration activities at the Green Bay Copper-Gold Project.

As announced on 30 April 2025, the Company appointed BMO Capital Markets to assist with a strategic review with respect to the Company’s 70% interest in the high-grade Pickle Crow Gold Project (Strategic Review). The objective of the Strategic Review is to evaluate options to maximise value for shareholders and allow the Company to focus on progressing the Green Bay Copper-Gold Project. The BMO-led Strategic Review, including a thorough evaluation of strategic alternatives and recommendations to maximise shareholder value, is being evaluated and finalised. A conclusion is expected to be completed and released to the market by the end of 2025.

Investors are cautioned that there is no guarantee that the Strategic Review will result in the divestment of all or any part of the Company’s interest in the Pickle Crow Gold Project and the Company will otherwise keep the market updated in accordance with its continuous disclosure obligations.

CORPORATE

S&P/ASX 300 Index

On 5 September 2025, the Company was announced by S&P Dow Jones Indices as an addition to the S&P/ASX 300 Index, effective prior to the open of trading on 22 September 2025, as a result of the September quarterly review.

FINANCIAL OVERVIEW

Share Purchase Plan (SPP)

On 11 July 2025, FireFly announced that due to strong investor demand it had doubled its SPP from A$5.0 million to A$10.0 million. The SPP was completed on 14 July 2025, with the issue of 10,416,666 ordinary fully paid shares in the Company (New Shares).

The SPP was undertaken concurrently with the Company’s broader equity raising of ~A$98.1 million comprising the following components (together, the Equity Raising):

- ~A$11.2 million (~C$10.0 million) charity flow-through placement to Canadian investors at a price of approximately A$1.49 per share (Charity Flow-Through Placement) which completed on 13 June 2025 with the issue of 7,559,539 New Shares;

- ~A$54.9 million two-tranche institutional placement at a price of A$0.96 per share (Institutional Placement) of which the first tranche completed on 16 June 2025 with the issue of 28,064,281 New Shares and second tranche completed on 3 September 2025 with the issue of 29,166,667 New Shares; and

- ~A$32 million (C$28.4 million) fully underwritten Canadian bought deal offering with BMO Capital Markets at a price of C$0.86 per share (Canadian Offering) which completed on 23 June 2025 with the issue of 33,000,000 New Shares.

The net proceeds from the Equity Raising and SPP are primarily allocated to exploration and development expenditures at the Green Bay Copper-Gold Project, including underground development, resource extension and infill drilling, regional and near mine exploration and drill testing, and pre-construction and study works. The net proceeds were also be used to cover transaction costs of conducing the Equity Raising and will also be used for working capital.

CASH FLOW

At 30 September 2025, FireFly had a cash balance of A$114.3 million. During the quarter, the Company incurred net cash outflows from operating activities of A$2.8 million and investing activities of $17.8 million. The Company received net cash inflows from financing activities of A$35.3 million. Key movements by activity classification are provided below.

Operating Activities

The net cash outflow from operating activities for the quarter of A$2.8 million comprised:

- A$0.6 million payments for care and maintenance and site costs associated with the Green Bay Copper-Gold Project;

- A$0.9 million for payments of annual insurance premiums, payroll tax (for the prior financial year) and prepaid expenses;

- A$2.3 million payments for staff, administration and corporate costs in both Australia and Canada; and

- A$1.0 million receipts of interest and other income.

Investing Activities

The net cash outflow from investing activities for the quarter of A$17.8 million comprised:

- A$18.1 million for payments associated with the underground development drive, exploration drilling, and project and engineering studies expenditure at the Green Bay Copper-Gold Project;

- A$0.1 million for acquisition of plant and equipment; and

- A$0.4 million of proceeds received from the sale of plant and equipment.

Financing Activities

Net cash inflows from financing activities for the quarter of A$35.3 million comprised:

- A$10.0 million of gross proceeds from completion of the SPP on 14 July 2025;

- A$28.0 million of gross proceeds from completion of tranche two of the Institutional Placement on 3 September 2025, offset by:

- payment of A$2.5 million for transaction costs associated with the Equity Raising; and

- A$0.2 million for payments associated with the lease of equipment for the Green Bay Copper-Gold Project and office space.

PAYMENTS TO RELATED PARTIES

During the quarter, the Company made payments to related parties of A$380,000 which comprised executive directors’ salaries and superannuation, non-executive directors’ fees, and payments to Exia-IT Pty Ltd for IT support services and IT equipment.12

For and on behalf of the Board.

| Mr Steve Parsons | Jessie Liu-Ernsting | Media: |

| Managing Director | Corp Dev & IR | Paul Armstrong |

| FireFly Metals Ltd | FireFly Metals Ltd | Read Corporate |

| Phone: +61 8 9220 9030 | +1 709 800 1929 | +61 8 9388 1474 |

ABOUT FIREFLY METALS

FireFly Metals Ltd (ASX, TSX: FFM) is an emerging copper-gold company focused on advancing the high-grade Green Bay Copper-Gold Project in Newfoundland, Canada. The Green Bay Copper-Gold Project currently hosts a Mineral Resource prepared and disclosed in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code 2012) and Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101) of 24.4Mt of Measured and Indicated Resources at 1.9% for 460Kt CuEq and 34.5Mt of Inferred Resources at 2% for 690Kt CuEq. The Company has a clear strategy to rapidly grow the copper-gold Mineral Resource to demonstrate a globally significant copper-gold asset. FireFly has commenced a 130,000m diamond drilling program.

FireFly holds a 70% interest in the high-grade Pickle Crow Gold Project in Ontario. The current Inferred Resource stands at 11.9Mt at 7.2g/t for 2.8Moz gold, with exceptional discovery potential on the 500km2 tenement holding.

The Company also holds a 90% interest in the Limestone Well Vanadium-Titanium Project in Western Australia.

For further information regarding FireFly Metals Ltd please visit the ASX platform (ASX:FFM), the Company’s website www.fireflymetals.com.au or SEDAR+ at www.sedarplus.ca.

COMPLIANCE STATEMENTS

Financial Information

Financial Information included in this announcement, including the Appendix 5B, is unaudited and has not been reviewed by the Company’s external auditor.

Mineral Resources Estimate – Green Bay Project

The Mineral Resource Estimate for the Green Bay Project referred to in this announcement and set out in Appendix A was first reported in the Company’s ASX announcement dated 29 October 2024, titled “Resource increases 42% to 1.2Mt of contained metal at 2% Copper Eq” and is also set out in the Technical Reports for the Ming Copper Gold Mine, titled “National Instrument 43-101 Technical Report, FireFly Metals Ltd, Ming Copper-Gold Project, Newfoundland” with an effective date of 29 November 2024 and the Little Deer Copper Project, titled “Technical Report and Updated Mineral Resource Estimate of the Little Deer Complex Copper Deposits, Newfoundland, Canada” with an effective date of 26 June 2024, each of which is available on SEDAR+ at www.sedarplus.ca.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the Mineral Resource Estimate in the original announcement continue to apply and have not materially changed.

Mineral Resources Estimate – Pickle Crow Project

The Mineral Resource Estimate for the Pickle Crow Project referred to in this announcement was first reported in the Company’s ASX announcement dated 4 May 2023, titled “High-Grade Inferred Gold Resource Grows to 2.8Moz at 7.2g/t” and is also set out in the Technical Report for the Pickle Crow Project, titled “NI 43-101 Technical Report Mineral Resource Estimate Pickle Crow Gold Project, Ontario, Canada” with an effective date of 29 November 2024, as amended on 11 June 2025, available on SEDAR+ at www.sedarplus.ca.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the Mineral Resource Estimate in the original announcement continue to apply and have not materially changed.

Metal equivalents for Mineral Resource Estimates

Metal equivalents for Mineral Resource Estimates have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz and silver price of US$25/oz. Individual Mineral Resource grades for the metals are set out in Appendix A of this announcement. Copper equivalent was calculated based on the formula: CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822).

Metallurgical factors have been applied to the metal equivalent calculation. Copper recovery used was 95%. Historical production at the Ming Mine has a documented copper recovery of ~96%. Precious metal (gold and silver) metallurgical recovery was assumed at 85% on the basis of historical recoveries achieved at the Ming Mine in addition to historical metallurgical test work to increase precious metal recoveries.

In the opinion of the Company, all elements included in the metal equivalent calculations have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, the Company’s operational experience and, where relevant, historical performance achieved at the Green Bay project whilst in operation.

Metal equivalents for Exploration Results

Metal equivalents for Exploration Results have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz, silver price of US$25/oz and zinc price of US$2,500/t. Individual grades for the metals are set out in the ASX announcements in which the Exploration Results were first reported by the Company.

Metallurgical factors have been applied to the metal equivalent calculation. Copper recovery used was 95%. Historical production at the Ming Mine has a documented copper recovery of ~96%. Precious metal (gold and silver) metallurgical recovery was assumed at 85% based on historical recoveries achieved at the Ming Mine in addition to historical metallurgical test work to increase recoveries. Zinc recovery is applied at 50% based on historical processing and potential upgrades to the mineral processing facility.

In the opinion of the Company, all elements included in the metal equivalent calculation have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work and the Company’s operational experience.

Copper equivalent was calculated based on the formula CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822) + (Zn(%) x 0.15038).

Exploration Results

The Exploration Results referred to in this announcement were first reported by the Company in the ASX announcements cross-referenced in this announcement.

Original Announcements

FireFly confirms that it is not aware of any new information or data that materially affects the information included in the original announcements and that, in the case of estimates of Mineral Resources, all material assumptions and technical parameters underpinning the Mineral Resource Estimates in the original announcements continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Persons’ and Qualified Persons’ findings are presented have not been materially modified from the original market announcements.

Mineral Resource Estimates and Exploration Results

Mineral Resource Estimates and Exploration Results are calculated in accordance with the JORC Code 2012 and NI 43-101.

Competent and Qualified Person Statements

All technical and scientific information in this announcement has been reviewed and approved by Group Chief Geologist, Mr Juan Gutierrez BSc, Geology (Masters), Geostatistics (Postgraduate Diploma), who is a Member and Chartered Professional of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Mr Gutierrez is a Competent Person as defined in the JORC Code 2012 and a Qualified Person as defined in NI 43-101. Mr Gutierrez is a full-time employee of FireFly Metals Ltd and holds securities in FireFly Metals Ltd. Mr Gutierrez has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code 2012 and a Qualified Person as defined in NI 43-101. Mr Gutierrez consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

FORWARD-LOOKING INFORMATION

This announcement may contain certain forward-looking statements and projections, including statements regarding FireFly’s plans, forecasts and projections with respect to its mineral properties and programs. For example, this announcement may contain forward-looking statements and projections regarding estimated Mineral Resources, cost projections, plans, strategies and objectives and expected costs. Forward-looking statements may be identified by the use of words such as “may”, “might”, “could”, “would”, “will”, “expect”, “intend”, “believe”, “forecast”, “milestone”, “objective”, “predict”, “plan”, “scheduled”, “estimate”, “anticipate”, “continue”, or other similar words and may include, without limitation, statements regarding plans, strategies and objectives.

Although the forward-looking statements contained in this announcement reflect management’s current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, such forward-looking statements and projections are estimates only and should not be relied upon. They are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond the control of the Company, which may include changes in commodity prices, foreign exchange fluctuations, economic, social and political conditions, and changes to applicable regulation, and those risks outlined in the Company’s public disclosures.

The forward-looking statements and projections are inherently uncertain and may therefore differ materially from results ultimately achieved. For example, there can be no assurance that FireFly will be able to confirm the presence of Mineral Resources or Ore Reserves, that FireFly’s plans for development of its mineral properties will proceed, that any mineralisation will prove to be economic, or that a mine will be successfully developed on any of FireFly’s mineral properties. The performance of FireFly may be influenced by a number of factors which are outside the control of the Company, its directors, officers, employees and contractors. The Company does not make any representations and provides no warranties concerning the accuracy of any forward-looking statements or projections, and disclaims any obligation to update or revise any forward-looking statements or projections based on new information, future events or circumstances or otherwise, except to the extent required by applicable laws.

APPENDIX A

Green Bay Copper-Gold Project Mineral Resources

Ming Deposit Mineral Resource Estimate

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) |

Grade (%) |

Metal (‘000 t) |

Grade (g/t) |

Metal (‘000 oz) |

Grade (g/t) |

Metal (‘000 oz) |

Grade (%) |

|

| Measured | 4.7 | 1.7 | 80 | 0.3 | 40 | 2.3 | 340 | 1.9 |

| Indicated | 16.8 | 1.6 | 270 | 0.3 | 150 | 2.4 | 1,300 | 1.8 |

| TOTAL M&I | 21.5 | 1.6 | 340 | 0.3 | 190 | 2.4 | 1,600 | 1.8 |

| Inferred | 28.4 | 1.7 | 480 | 0.4 | 340 | 3.3 | 3,000 | 2.0 |

Little Deer Mineral Resource Estimate

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) |

Grade (%) |

Metal (‘000 t) |

Grade (g/t) |

Metal (‘000 oz) |

Grade (g/t) |

Metal (‘000 oz) |

Grade (%) |

|

| Measured | - | - | - | - | - | - | - | - |

| Indicated | 2.9 | 2.1 | 62 | 0.1 | 9 | 3.4 | 320 | 2.3 |

| TOTAL M&I | 2.9 | 2.1 | 62 | 0.1 | 9 | 3.4 | 320 | 2.3 |

| Inferred | 6.2 | 1.8 | 110 | 0.1 | 10 | 2.2 | 430 | 1.8 |

GREEN BAY TOTAL MINERAL RESOURCE ESTIMATE

| TONNES | COPPER | GOLD | SILVER | CuEq | ||||

| (Mt) |

Grade (%) |

Metal (‘000 t) |

Grade (g/t) |

Metal (‘000 oz) |

Grade (g/t) |

Metal (‘000 oz) |

Grade (%) |

|

| Measured | 4.7 | 1.7 | 80 | 0.3 | 45 | 2.3 | 340 | 1.9 |

| Indicated | 19.7 | 1.7 | 330 | 0.2 | 154 | 2.6 | 1,600 | 1.9 |

| TOTAL M&I | 24.4 | 1.7 | 400 | 0.3 | 199 | 2.5 | 2,000 | 1.9 |

| Inferred | 34.6 | 1.7 | 600 | 0.3 | 348 | 3.1 | 3,400 | 2.0 |

- Mineral Resource Estimates for the Green Bay Copper-Gold Project, incorporating the Ming Deposit and Little Deer Complex, are prepared and reported in accordance with the JORC Code 2012 and NI 43-101.

- Mineral Resources have been reported at a 1.0% copper cut-off grade.

- Metal equivalents for the Mineral Resource Estimates have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz and silver price of US$25/oz. Metallurgical recoveries have been assumed at 95% for copper and 85% for both gold and silver. Copper equivalent was calculated based on the formula: CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822).

- Totals may vary due to rounding.

APPENDIX B

Summary of interests in Mining Tenements and other tenure held by FireFly Metals Ltd and its wholly owned subsidiaries at the end of the September 2025 Quarter.

Limestone Well Vanadium Project

Western Australia

| PROJECT | TENEMENT NO. | STATUS | INTEREST | TENURE HOLDER |

| Limestone Well | E20/846 | Granted | 90% |

FireFly Metals Ltd |

| Limestone Well | E57/1069 | Granted | 90% |

FireFly Metals Ltd |

South Australian Projects

South Australia

| PROJECT | TENEMENT NO. | STATUS | INTEREST | TENURE HOLDER |

| Kulitjara | ELA 2013/168 | Application | 100% |

Monax Alliance Pty Ltd |

| Anmuryinna | ELA 2013/169 | Application | 100% |

Monax Alliance Pty Ltd |

| Poole Hill | ELA 2013/170 | Application | 100% |

Monax Alliance Pty Ltd |

Sioux Lookout Projects

Ontario, Canada

| PROJECT | TENEMENT NO. | STATUS | INTEREST | TENURE HOLDER | |||

| Sioux Lookout Projects | 674765 674766 674767 674768 674769 674770 674771 674772 674773 674774 674775 674776 674777 674778 674779 674780 |

674781 674782 674793 674794 674795 674796 674797 674798 674812 674813 674820 674821 674822 674823 674824 |

674825 674826 674827 674829 674830 674831 674832 674833 674834 674835 674836 674837 695865 695866 700951 |

Granted | 100% |

Revel Resources Ltd | |

Pickle Crow Gold Project

Ontario, Canada

FireFly has entered into an earn-in agreement with First Mining Gold Corp (TSX:FF) to acquire up to an 80% interest in PC Gold Inc, the 100% holder of the Mining Tenements outlined below comprising the Pickle Crow Gold Project. FireFly’s current interest in PC Gold Inc is 70%. For further details refer to ASX announcements dated 28 January 2020, 17 February 2020, 13 March 2020, 18 March 2021 and 2 August 2021.

GRANTED TENEMENT NO.

| 102631 | 153007 | 188547 | 225833 | 292410 | 344659 | 672203 | PA 65 (PAT 7365) |

| 102632 | 153008 | 189122 | 225834 | 292411 | 344681 | 672205 | PA 66 (PAT 7366) |

| 102636 | 153009 | 189170 | 225835 | 292412 | 344683 | 672206 | PA 665 (PA 2073) (PAT 7341) |

| 102637 | 153012 | 189214 | 226401 | 292416 | 344745 | 672207 | PA 666 (PA 2076) (PAT 7344) |

| 102655 | 153013 | 189695 | 226403 | 292417 | 345282 | 672208 | PA 667 (PA 2077) (PAT 7345) |

| 102656 | 153037 | 189900 | 227038 | 292431 | 345328 | 672209 | PA 668 (PA 2075) (PAT 7343) |

| 102688 | 153039 | 189903 | 227086 | 292453 | 345347 | 672210 | PA 669 (PA 2078) (PAT 7346) |

| 102716 | 153040 | 189922 | 227087 | 292454 | 345348 | 672211 | PA 67 (PAT 7367) |

| 102717 | 153068 | 189923 | 227106 | 292455 | 562622 | 672212 | PA 670 (PA 2070) (PAT 7339) |

| 102720 | 153615 | 196962 | 227793 | 293007 | 562636 | 672213 | PA 671 (PA 2074) (PAT 7342) |

| 102773 | 153617 | 196963 | 227821 | 293008 | 562648 | 672214 | PA 675 (PAT 7279) |

| 102796 | 153633 | 196967 | 227822 | 293009 | 562649 | 672215 | PA 676 (PAT 7280) |

| 102797 | 153740 | 196968 | 238344 | 293032 | 562650 | 672216 | PA 677 (PAT 7281) |

| 102827 | 153741 | 196969 | 238522 | 293035 | 562651 | 672217 | PA 68 (PAT 7368) |

| 102882 | 153759 | 196984 | 247646 | 293058 | 562652 | 672218 | PA 684 (PAT 7282) |

| 102979 | 154984 | 196985 | 247647 | 293547 | 562653 | 672219 | PA 685 (PAT 7283) |

| 103184 | 154985 | 196986 | 249298 | 293548 | 562654 | 672220 | PA 686 (PAT 7284) |

| 103203 | 155002 | 202396 | 257912 | 293675 | 562655 | 672221 | PA 69 (PAT 7352) |

| 112269 | 155022 | 203622 | 265530 | 293710 | 562656 | 672222 | PA 696 (PAT 7285) |

| 112270 | 157233 | 207336 | 265531 | 294406 | 562657 | 672223 | PA 697 (PAT 7286) |

| 117286 | 157234 | 207590 | 265581 | 294432 | 562658 | 672224 | PA 698 (PAT 7287) |

| 117311 | 161424 | 207603 | 265585 | 294433 | 562659 | 672225 | PA 699 (PAT 7288) |

| 117314 | 169618 | 207626 | 265601 | 305805 | 562660 | 672226 | PA 70 (PAT 7353) |

| 117315 | 169638 | 207649 | 265604 | 312407 | 562661 | 672227 | PA 700 (PAT 7289) |

| 117334 | 169639 | 207652 | 265623 | 312408 | 562662 | 672228 | PA 701 (PAT 7290) |

| 117335 | 169646 | 207653 | 265624 | 312492 | 562663 | 672229 | PA 702 (PAT 7291) |

| 117935 | 169672 | 207654 | 266182 | 321608 | 562664 | 672230 | PA 703 (PAT 7292) |

| 117936 | 169674 | 207655 | 266185 | 321614 | 562665 | 672231 | PA 704 (PAT 7293) |

| 117942 | 169675 | 207657 | 266188 | 321616 | 562666 | 672232 | PA 705 (PAT 7294) |

| 117947 | 169709 | 207720 | 266203 | 321617 | 562667 | 672233 | PA 706 (PAT 7295) |

| 117948 | 169710 | 208244 | 266205 | 321618 | 562668 | 672234 | PA 707 (PAT 7296) |

| 117969 | 169711 | 208316 | 266847 | 321619 | 562669 | 672235 | PA 725 (PAT 7297) |

| 117970 | 170264 | 208340 | 266850 | 321622 | 562670 | 672236 | PA 726 (PAT 7298) |

| 117977 | 170269 | 208385 | 267574 | 321636 | 562672 | 672237 | PA 727 (PAT 7299) |

| 117998 | 170280 | 208401 | 272992 | 321667 | 562673 | 672238 | PA 728 (PAT 7300) |

| 117999 | 170281 | 208405 | 273007 | 321669 | 562674 | 672239 | PA 729 (PAT 7301) |

| 118002 | 170302 | 208406 | 273011 | 321673 | 562675 | 672240 | PA 730 (PAT 7302) |

| 118032 | 170303 | 208936 | 273012 | 321683 | 562676 | 672241 | PA 735 (PAT 7303) |

| 118094 | 170304 | 208938 | 273017 | 321699 | 562677 | 672242 | PA 736 (PAT 7304) |

| 118095 | 170362 | 209208 | 273572 | 321700 | 562678 | 672243 | PA 737 (PAT 7305) |

| 118115 | 170363 | 209914 | 273618 | 322281 | 562679 | 672244 | PA 738 (PAT 7306) |

| 118121 | 170889 | 209915 | 273619 | 322284 | 562680 | 672245 | PA 739 (PAT 7307) |

| 118227 | 170936 | 210048 | 273620 | 322303 | 562681 | 672246 | PA 740 (PAT 7308) |

| 118288 | 170957 | 215596 | 273642 | 322304 | 562682 | 672247 | PA 741 (PAT 7409) |

| 124493 | 171607 | 217803 | 273643 | 322361 | 562683 | 672248 | PA 742 (PAT 7310) |

| 124494 | 171632 | 217811 | 273644 | 322387 | 562684 | 672249 | PA 744 (PAT 7312) |

| 124495 | 171633 | 217812 | 273663 | 322388 | 562685 | 672250 | PA 745 (PAT 7313) |

| 124496 | 171655 | 218333 | 273664 | 322949 | 562690 | 672251 | PA 746 (PAT 7314) |

| 124519 | 171905 | 218335 | 274255 | 322950 | 562765 | 672252 | PA 747 (PAT 7315) |

| 124522 | 173067 | 218362 | 274303 | 322951 | 562766 | 672253 | PA 748 (PAT 7316) |

| 124523 | 173068 | 218363 | 274325 | 323594 | 562767 | 672579 | PA 749 (PAT 7317) |

| 125042 | 173091 | 218364 | 275021 | 323613 | 562768 | 695862 | PA 750 (PAT 7318) |

| 125043 | 173136 | 218365 | 275022 | 323614 | 562769 | 695863 | PA 751 (PAT 7319) |

| 125075 | 173138 | 218368 | 275031 | 323615 | 562770 | 711253 | PA 755 (PAT 7320) |

| 125076 | 173544 | 218369 | 275087 | 323616 | 562771 | 711477 | PA 756 (PAT 7321) |

| 125145 | 173853 | 218381 | 275551 | 323620 | 562772 | 719977 | PA 757 (PAT 7322) |

| 125147 | 173854 | 218392 | 276008 | 323640 | 562774 | 720020 | PA 758 (PAT 7323) |

| 125150 | 173875 | 218393 | 285057 | 324716 | 562776 | 887527 | PA 759 (PAT 7324) |

| 125151 | 182415 | 218448 | 285058 | 325337 | 562777 | PA 185 (PA 2061) (PAT 7354) | PA 760 (PAT 7325) |

| 125176 | 182433 | 218449 | 285059 | 325338 | 562778 | PA 186 (PA 2062 & PA 2062A) (PAT 7355) | PA 761 (PAT 7326) |

| 125177 | 182434 | 218450 | 285060 | 333761 | 562779 | PA 187 (PA2063) (PAT 7356) | PA 762 (PAT 7327) |

| 125772 | 182438 | 218470 | 285069 | 334628 | 562781 | PA 188 (PA 2064) (PAT 7359) | PA 763 (PAT 7328) |

| 125797 | 182440 | 218471 | 285076 | 334629 | 572086 | PA 189 (PA 2065) (PAT 7357) | PA 773 (PAT 7329) |

| 125837 | 182468 | 218480 | 285088 | 335092 | 626535 | PA 199 (PA 2067) (PAT 7361) | PA 774 (PAT 7330) |

| 125856 | 182472 | 218481 | 285089 | 335442 | 672170 | PA 200 (PA 2068) (PAT 7362) | PA 775 (PAT 7331) |

| 127040 | 182473 | 219051 | 285090 | 335443 | 672171 | PA 201 (PA 2066) (PAT 7360) | PA 776 (PAT 7332) |

| 127041 | 183017 | 219052 | 285091 | 335446 | 672172 | PA 2011 (PAT 7338) | PA 777 (PAT 7333) |

| 127444 | 183069 | 219053 | 285629 | 335468 | 672173 | PA 202 (PA 2069) (PAT 7358) | PA 778 (PAT 7334) |

| 135139 | 183090 | 219054 | 285634 | 344008 | 672174 | PA 2071e (PA 2071 & PA 2072) (PAT 7340) | PA 779 (PAT 7335) |

| 137058 | 183091 | 219055 | 285635 | 344010 | 672175 | PA 2133 (PAT 7347) | PA 780 (PAT 7336) |

| 137059 | 183092 | 219145 | 285652 | 344012 | 672176 | PA 2139 (PAT 7348) | PA 781 (PAT 7337) |

| 137060 | 183093 | 219146 | 285657 | 344013 | 672177 | PA 2140 (PAT 7349) | PA 90 (PA 2161) (PAT 6945) |

| 137199 | 183115 | 219147 | 285708 | 344014 | 672178 | PA 2141 (PAT 7350) | PA 91 (PA 2157) (PAT 6946) |

| 137200 | 183118 | 219166 | 285709 | 344029 | 672179 | PA 2185 (PAT 7351) | PA 92 (PA 2158) (PAT 6947) |

| 137848 | 188411 | 219167 | 285732 | 344030 | 672180 | PA 2586(PAT6952) | PA 93 (PA 2159) (PAT 6948) |

| 143310 | 188414 | 220349 | 285734 | 344031 | 672194 | PA 63 (PAT 7363) | PA 94 (PA 2162) (PAT 6949) |

| 147879 | 188415 | 220350 | 285759 | 344580 | 672195 | PA 637 (PAT 7273) | PA 95 (PA 2163) (PAT 6950) |

| 151198 | 188422 | 220351 | 286396 | 344581 | 672196 | PA 638 (PAT 7274) | PA 96 (PA 2160) (PAT 6951) |

| 152985 | 188443 | 225800 | 286415 | 344582 | 672197 | PA 639 (PAT 7275) | |

| 152991 | 188444 | 225801 | 287100 | 344583 | 672198 | PA 64 (PAT 7364) | |

| 152992 | 188445 | 225802 | 287122 | 344584 | 672199 | PA 640 (PAT 7276) | |

| 152993 | 188446 | 225804 | 287631 | 344633 | 672200 | PA 644 (PAT 7277) | |

| 152998 | 188502 | 225818 | 292388 | 344637 | 672201 | PA 646 (PAT 7278) | |

| 153006 | 188519 | 225819 | 292389 | 344655 | 672202 | PA 743 (PAT 7311) | |

FireFly wholly-owned subsidiaries Revel Resources Ltd and Revel Resources (JV Projects) Ltd are also 100% holder of the following granted Mining Tenements located in proximity to the above Pickle Crow Project Mining Tenements.

GRANTED TENEMENT NO.

| PROJECT | TENEMENT NO. | STATUS | INTEREST | TENURE HOLDER | |

| Pickle Crow | 711863 711867 711868 |

Granted | 100% |

Revel Resources Ltd | |

| Pickle Crow | 695864 | Granted | 100% |

Revel Resources (JV) Projects Ltd | |

Green Bay Copper-Gold Project

Newfoundland and Labrador, Canada

| PROJECT | TENEMENT NO. | STATUS | INTEREST | TENURE HOLDER | ||||

| Green Bay | 022791M 023175M |

023968M 023971M |

027468M | Granted | 100% |

FireFly Metals Canada Ltd | ||

| Green Bay | 010215M | Granted | 100% |

FireFly Metals Canada Ltd (50%) 1948565 Ontario Inc (50%) |

||||

| Green Bay | Crown Land Lease 103359 Crown Land Lease 103388 Crown Land Lease 108189 Crown Land Lease 108691 Mining Lease 140 Mining Lease 141 Mining Lease 188 Surface Lease 163 |

Granted | 100% |

FireFly Metals Canada Ltd | ||||

| Green Bay | 011507M 019026M 019060M 019158M 020510M 023708M 023732M 025546M 025547M 025548M |

025549M 025552M 025853M 026769M 026770M 027500M 030871M 031375M 031800M 032148M |

032685M 034271M 034282M 034366M 034399M 034902M 035201M 035487M 035654M 036297M |

Granted | 100% |

1470199 B.C LTD | ||

| Tilt Cove | 013054M 013055M 014109M 014111M 019122M 022576M 022796M 024119M 024535M 025051M 025291M 025437M |

025558M 025832M 025838M 026202M 026379M 026404M 026540M 026680M 026729M 026730M 026950M 026992M |

027285M 027398M 031602M 031816M 032906M 034851M 034854M 035078M 035079M 035080M 035081M 037157M |

Granted | 100% |

Tilt Cove Ltd. | ||

Mining Tenements and Beneficial Interests acquired during the Quarter: Nil

Mining Tenements and Beneficial Interests disposed of during the Quarter: Nil

________________________________

1 Metal equivalent for drill results reported in this announcement have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz, silver price of US$25/oz and zinc price of US$2,500/t. Metallurgical recoveries have been set at 95% for copper, 85% for precious metals and 50% for zinc. CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822) + (Zn(%) x 0.15038). In the opinion of the Company, all elements included in the metal equivalent calculation have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, and historical performance achieved at the Green Bay project whilst in operation.

2 with a processing plant throughput capacity of 1.8 Mtpa. Investors are cautioned that the plant capacity is a technical specification forming part of the environmental submission and is not a forecast of the estimated production of the mining operation. The mining operation’s forecast production will not be estimated until such time as the Company has prepared and announced its Scoping Study. Should a larger scale case be adopted than contemplated by the Environmental Release, further assessment will be required by government agencies.

3 Cash, receivables and liquid investments position at 30 September 2025.

4 Holes are drilled perpendicular to the mineralisation and approximate true thickness.

5 Holes are drilled perpendicular to the mineralisation and approximate true thickness.

6 The first economic study (Scoping Study) will be prepared in accordance with ‘Scoping Study’ requirements for the purposes of 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code 2012) and ‘Preliminary Economic Assessment’ requirements for the purposes of the 2019 Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards and Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101).

7 Refer to ASX announcement dated 29 October 2024 and Appendix B of this announcement for further details of the Mineral Resource Estimate (MRE). The current MRE contains 24.4Mt for 199koz of contained gold in the Measured and Indicated Mineral Resource categories, and 34.6Mt for 348koz in the lower-confidence Inferred Mineral Resource category.

8 Investors are cautioned that the plant capacity is a technical specification forming part of the environmental submission and is not a forecast of the estimated production of the mining operation. The mining operation’s forecast production will not be estimated until such time as the Company has prepared and announced its Scoping Study. Should a larger scale case be adopted than contemplated by the Environmental Release, further assessment will be required by government agencies.

9 ‘Scoping Study’ is defined in footnote 6.

10 Refer to ASX announcement dated 29 October 2024 and Appendix A of this announcement for further details on the current Mineral Resource Estimate.

11 The proposed timing of the updated MRE and the economic studies is indicative and may be subject to change.

12 Exia IT Pty Ltd, a company in which Belltree Corporate Pty Ltd (Belltree) is a 50% shareholder, provided IT services and supplied IT equipment to the Company. Mr Naylor is a director of Belltree and holds a 30% indirect interest and Mr Parsons also holds a 20% indirect interest. There were no payments made to Belltree during the quarter.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c2f5d82f-6871-4e1f-802a-7512a9b4f0be

https://www.globenewswire.com/NewsRoom/AttachmentNg/053ab09a-7c21-498a-b9f8-97ff873a4b4c

https://www.globenewswire.com/NewsRoom/AttachmentNg/38f15b9c-a152-4261-96ed-e5bfac313151

https://www.globenewswire.com/NewsRoom/AttachmentNg/56952a0c-4c5b-40b3-ab4e-4742afa544c6

https://www.globenewswire.com/NewsRoom/AttachmentNg/0a82e857-9fe1-477a-98f7-1c151c75ef9c

https://www.globenewswire.com/NewsRoom/AttachmentNg/e8e6d488-399a-44c9-8487-fbbddbbbb0e3

https://www.globenewswire.com/NewsRoom/AttachmentNg/f6926f19-3ef9-4587-ac31-d5111239b8c1

Figure 1

Long section through the Green Bay Ming underground mine showing the location of select drill results from ASX announcement dated 17 July 2025. Results from both the high-grade copper-gold VMS zone and broad copper Footwall Zone are shown. The green shape is a modelled DHEM anomaly (from hole MUG25-040 - see ASX announcement dated 7 May 2025 for further details). Drill assays >0.5% copper are shown in red.

Figure 2

Long section through the Ming Mine highlighting the current ~800m strike of the extremely high-grade core zone and remains open. The FWZ stringer style mineralisation is developed directly beneath the upper high-grade VMS. Clipping +/- 30m

Figure 3

Long section through the Ming Mine showing the location of drill platforms and drilling reported in the ASX announcement dated 17 July 2025. Assay results greater than 0.5% Cu are shown in red.

Figure 4

Isometric view of drill positions in the 805L Exploration drill drive. Drill results from the ASX announcement dated 17 July 2025 are shown with copper assays >0.5% shown in red.

Figure 5

Multiple significant new targets from the recent airborne VTEM and magnetic geophysical surveys. The white dots represent bedrock conductive anomalies. There are numerous untested conductive trends in a similar orientation (yellow boxes) to the known mineralisation at the Ming, Rambler Main and East Mines (white boxes). So far, a total of 325 conductive responses have been identified which are significant and potentially caused by copper-gold bearing sulphide mineralisation.

Figure 6

Tilt Cove Copper-Gold Project area showing the large-scale conductor (red) identified by FireFly’s ground-based EM survey. This conductor is significant and potentially caused by copper-gold bearing sulphide mineralisation. These results confirm an anomaly earlier identified in a 1983 EM survey completed by Newmont Exploration. The anomaly has yet to be drill tested and will be the subject of maiden drilling later in 2025.

Figure 7

Key 2024-2025 milestones for the Green Bay Copper-Gold Project. 1. Timelines are indicative and may be subject to change.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.